NFTs as foundational Metaverse infrastructure

October 5TH, 2021

However bullish you are on NFTs, you are wrong. You are insufficiently bullish.

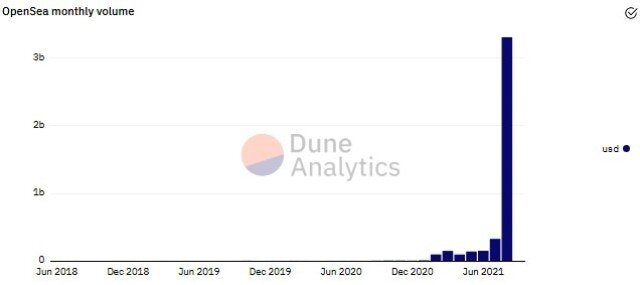

The NFT industry has exploded in popularity this year. There was more than $2.5 billion in sales volume during the first half of 2021, and it has only accelerated since then, with the top 10 projects generating $1.3B in sales volume over the past month alone. At the time of this writing, four projects have recorded sales in excess of $100M over the past month, with Axie Infinity leading the way, generating $505M in sales over that period. OpenSea, the most popular NFT marketplace, saw more than $3 billion in NFT sales volume during the month of August alone.

As I’ve watched the NFT industry explode over the last few months, it has become clear to me that I was drastically underestimating the both the industry's near-term and long-term potential. So, what are NFTs being used for, and what is driving their value? Let’s start by taking a look at three of the most popular use cases today.

Collectibles: Value is derived from narrative, scarcity, collector consensus.

Game Assets: Value is derived from the asset’s in-game utility.

Art: Value is derived from essentially the same factors that value traditional art.

Collectibles

CryptoPunk #3100 - last sold for 4,200 ETH ($8M)

Collectibles have historically been known an assets class with little to no intrinsic value. Collectibles have no future cash flows to discount and rely purely on the consensus of other collectors to establish value. Collectibles usually have a limited supply, which makes collectors confident in the rarity of the asset. Baseball cards are just pieces of cardboard with images on them. What makes them valuable are the players on the card, the rarity of individual cards, the condition of the cards, brand of the cards, and other contextual clues like historical significance. All these factors matter because they help build narrative around the asset that drives collector consensus. If collectors know the player is one of the best, the rarity is a 1-of-1, and the condition is perfect - collectors will have the narrative context that allows them to perceive that collectible as valuable. Similarly, collectible NFTs such as CryptoPunks or Bored Ape Yacht Club apes have no intrinsic value, but rather derive their value from the narrative around their rarity, brand, historical significance, provenance, etc.

Game Assets

Axie Infinity - Angel - last sold for 300 ETH ($135K)

The value of a game asset is derived from the asset’s utility within a game. Why did Angel sell for this much? Because it has the potential to be one of the strongest assets within the game Axie Infinity. Angel can be upgraded to make it very powerful in combat. The more battles Angel can win, the more assets its owner can acquire, and earn more money. Thus, Angel has intrinsic value that directly correlates to its value as a game asset. This model is not new to NFTs. 'Leveling Up' in-game characters via digital possessions has been a tried and true in-game monetization method for a long time. At the end of the day, the same applies to NFT game assets. My NFT sword does 10x damage and your NFT sword does 100x damage, your sword is likely much more valuable. One upgrade that NFT game assets bring to the table is provenance, or a record of ownership showing who owned the asset previously. I would rather own a 100x damage sword if it was previously owned by a famous Twitch streamer, versus a similar sword that without that provenance.

I would be remiss if I didn't mention Loot Project under this section. Pictured below, is a Loot bag: a text file consisting of 8 phrases overlaid on a black background. As it turns out, this text file is also an NFT, “Loot Bag #748,” and it sold for 421 ETH, or about $1.4M at current prices.

On August 27th, Dom Hoffmann, who notably co-founded Vine, introduced Loot. A project consisting of 8,000 NFTs full of words that depict “randomized adventurer gear.” Two things set Loot apart. First, these NFTs could be claimed for free. The claimee simply had to pay the standard Ethereum gas fee. The other more obvious differentiator: these NFTs are just a bunch of words. What's the catch? Instead of just being a single provably scarce image, each of the 8 items within a given Loot bag has smart contract readable parameters. On top of that, each of the 8 items has its own rarity within the broader Loot universe. The exciting thing about Loot isn't what the NFTs are today, but what they could be. Anyone can build something using Loot NFTs as a foundation. Loot and its 8,000 NFTs can serve as the foundation of an entire gaming metaverse. The ideal end state being an entire ecosystem of games where Loot items like the ‘Divine Robe of the Fox’ serve different functions: think Dungeons & Dragons in the metaverse. Whoever builds something on top of Loot NFTs can determine the function served by a given item. By building the foundation of a game, without building a game itself, Loot leaves its fate in the hands of a decentralized community. This is a game development model unlike anything the world has seen before, and it's powered by NFTs.

Art

Beeple, Everydays - The First 5000 Days - last sold for $69M

The value behind NFT art is largely driven by the same factors that establish the value of traditional art. Sotheby’s valuation factors include authenticity, condition, rarity, provenance, historical significance, size, fashion, subject matter, medium, quality of materials used. Obviously not all metrics will directly apply to NFT art, but this framework largely still applies. Authenticity is paramount. Rarity is essential. Provenance is exceptionally important. Historical significance becomes more important every day. Subject matter is valued in the eye of the beholder. There’s really not much else to say about digital art- it’s valued in essentially the same fashion as traditional art. It is obvious that NFTs are the "internet moment" for art. The art establishment is going to get flippened because it is behaving exactly as conventionally as any other incumbent. It is amusing to see in this "creative" and "counter-cultural" field.

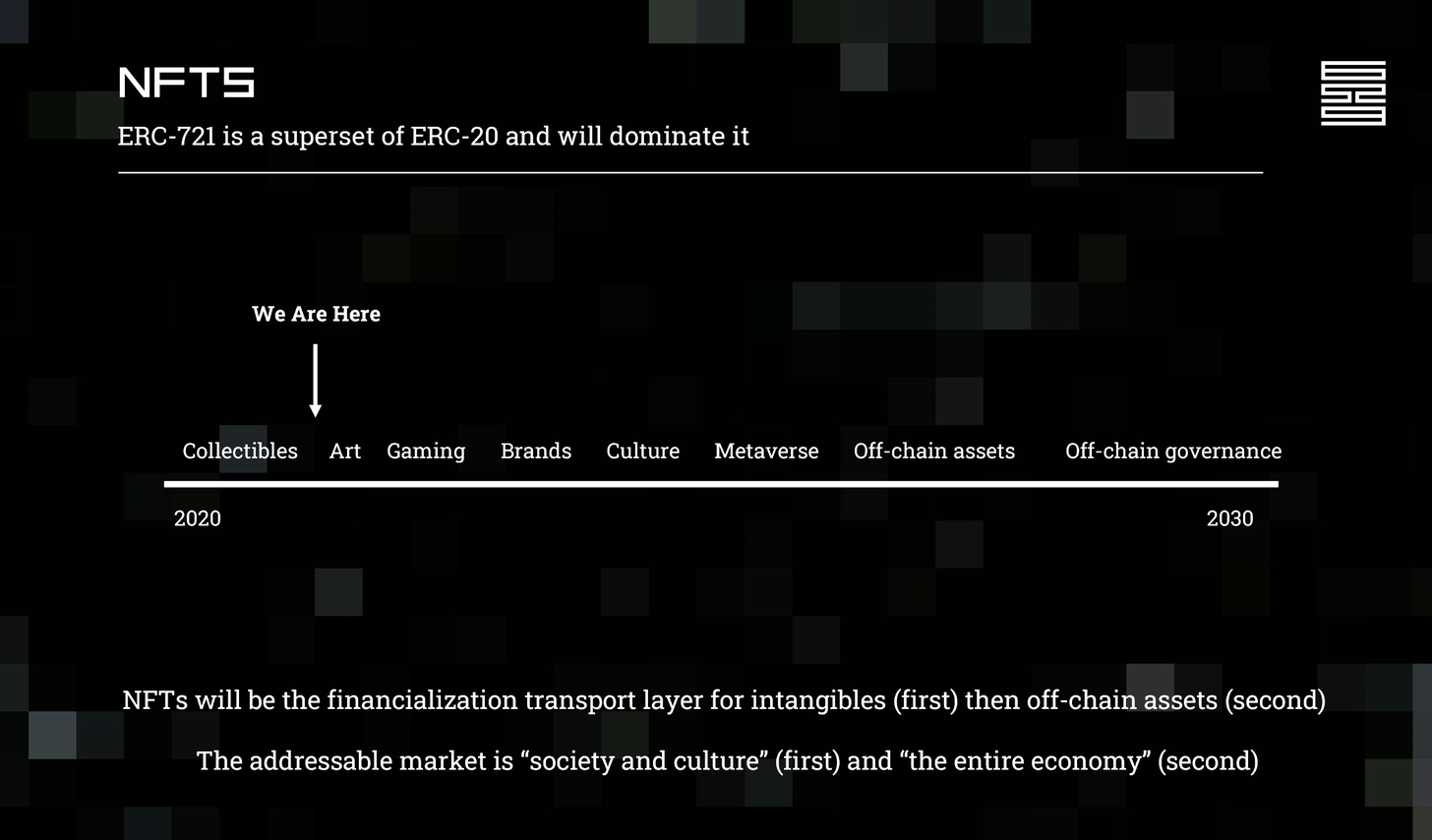

One massive mistake people make, including some of my best friends in crypto, including 2011 to 2013 crypto OGs is thinking that the scope of NFTs is "art." Art is only a subset of societal intangibles. The cutting-edge subset, but a subset none-the-less. After they flippen art, NFTs will start eating brands, then they will start eating culture, then they will start creating decentralized alternatives to centralized organizations.

So what exactly is driving this digitization of societal intangibles? The answer is a confluence of trends reaching their inflection points simultaneously. Digital natives would rather own digital collectibles and digital art than their physical counterparts, which means that we are watching the digitization of those industries. A bi-product of this is that we are watching the real-time digitization of status games. Each individual that would normally drop $50,000 to $1,000,000 to purchase a Rolex, painting, house, Lambo, etc is now realizing that you can spend the same money on a digital good and flex in front of a lot more people on the internet. Only so many friends can check out your Rolex and be impressed. But millions of people a month will see your Twitter avatar. Thus, we are seeing the NFT industry not only eat, but expand the markets of art, collectibles, high-end status symbols, etc, but that's only the beginning.

Gaming will be eaten next. I touched upon it earlier, but we’re only in the first inning of NFTs impacting the gaming vertical, and it has already resulted in Axie Infinity valued at $3B via their latest round led by a16z. The importance of the Loot model cannot be overstated. The Metaverse will actually happen this decade. If it is open- i.e. user owned and built on the decentralized foundations of a network of projects like Loot- human innovation will flourish. If it is closed- i.e. built and owned by Facebook or Epic- we are digital serfs of sorts. Loot, ‘games’ like it, and 100,000 or so NFT users right now are the front-line in this battle, and we will win.

From there, frankly, it is overwhelming to think through all the possibilities of where NFTs could go. Are CryptoPunks a silly collectible, or are they a decentralized lifestyle brand that will compete with Yeezy, Supreme, etc? The latter. Will the digitization of physical goods eat new markets in the same way it ate music, film and media? Yes. The addressable market for NFTs is, in its first phase, all societal intangibles. These represent tens of trillions of value and are the coordinating mechanism of societal hierarchy.

If you’re an investor and just starting to learn about NFTs, I highly suggest you take the time to get up to speed as quickly as possible. As to whether NFTs are in a bubble? Perhaps. It wouldn’t surprise me if most profile pic NFTs go to zero over the next few years. It also wouldn’t surprise me if tier-one NFT brands, like Cryptopunks, Bored Ape Yacht Club, Bitnauts, Loot, etc. significantly increased in value in the coming years. Investing in NFTs isn’t all that different from early stage tech investing- investors must cut through the noise to find signal in the most promising new projects that will build enduring value. If investors are able to do that, I believe NFTs will offer a return profile similar to that of Bitcoin in ~2013.